Cloud-Based Payroll Software: Flexibility and Efficiency Combined

In today’s changing business landscape, many companies are realizing the benefits of utilizing cloud-based technologies to enhance flexibility and efficiency. One specific area where this trend is evident is in the realm of payroll management. Traditional on-premises payroll solutions often demand investments in hardware, software, and IT support, presenting challenges for medium-sized enterprises.

Conversely, cloud-based payroll software offers a host of advantages that can streamline operations, save time, and improve accuracy. This article delves into how cloud-based payroll software combines flexibility and efficiency to aid businesses in managing their payroll.

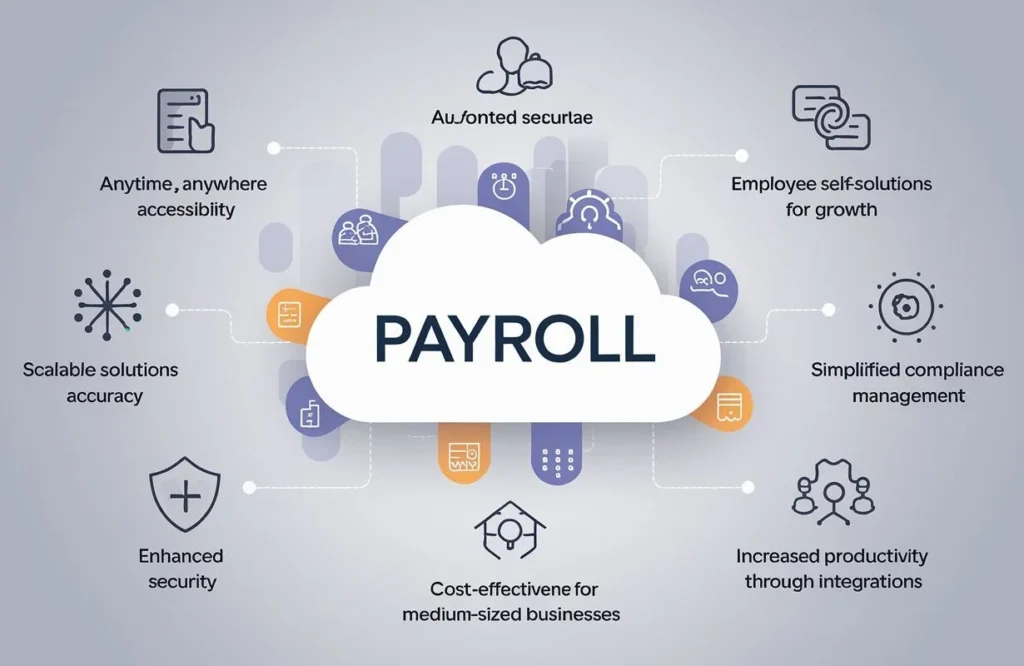

Benefits of Cloud-Based Payroll Software

1. Anytime Anywhere Accessibility

By adopting a cloud-based payroll solution, businesses can access their payroll system from any location with an internet connection. This allows key personnel, such as HR professionals or managers, to remotely handle tasks like managing employee information, processing pay statements, and generating reports without being confined to an office space. Moreover, the option for access facilitates collaboration among teams operating in diverse locations or across various company branches.

2. Employee Self-Service Flexibility

Cloud-based payroll systems often come with self-service portals for employees. These portals allow staff members to access their payslips and tax documents, request time off, or update information like addresses or bank details securely. Empowering employees in managing these aspects not only adds convenience but also lightens the administrative load for HR professionals.

3. Adapting to Business Growth Needs

As a company expands and its workforce grows, manual payroll processing using spreadsheets or outdated systems becomes more cumbersome and error-prone. However, cloud-based payroll solutions offer scalability, enabling organizations to effortlessly handle a number of employees without expenses or infrastructure upgrades.

4. Accuracy through Automation

Payroll computations involve elements such as base salaries, tax deductions, overtime calculations, bonuses, or commissions on leave accruals. Manually inputting this data carries a risk of errors. In contrast, cloud-based payroll software automates these calculations, reducing the likelihood of mistakes. Moreover, such software integrates seamlessly with systems like time tracking and HR management tools, streamlining data transfer and eliminating entries.

5. Simplified Compliance Management

Ensuring compliance with tax requirements is essential for any business. Cloud-based payroll software frequently includes built-in compliance features that automatically calculate taxes and handle deductions (such as Social Security or 401(k)). It also produces reports to simplify the process. Regular updates ensure that the system stays compliant with changing tax regulations.

6. Enhanced Security and Data Protection

Cloud-based payroll solutions come with security measures to safeguard employee information, including robust encryption protocols and access controls. Small businesses lacking IT resources may find it challenging to maintain data security. By relying on a cloud provider with expertise in cybersecurity, businesses can focus on their core activities, knowing that their payroll data is well protected.

7. Cost Effectiveness for Medium-Sized Businesses

Traditional on-premises payroll systems can be costly for medium-sized businesses operating on limited budgets. These systems often require investments in hardware, software licenses, and ongoing IT support expenses. In contrast, cloud-based payroll software operates on a subscription basis, eliminating the need for capital investments and reducing costs. Moreover, updates and maintenance are typically handled by the cloud provider, saving businesses from expenses related to system upgrades or problem-solving.

8. Enhanced Productivity through Integrations

Cloud-based payroll software allows for connections with other business applications like accounting software, time-tracking tools, and human resources management platforms. These connections remove the necessity for data input across systems, enhancing precision and cutting down on burdens. Information from these interconnected systems can seamlessly and securely transfer into the payroll system automatically. This not only saves time but also minimizes the potential for errors that often arise from manual data transfers.

Also Read About Maximizing Efficiency with Oracle Cloud Integration

Summary

As businesses increasingly adopt advancements, cloud-based payroll software provides a solution that melds flexibility with effectiveness. Organizations can streamline operations while effectively handling payroll tasks by utilizing access, automation, scalability, simplified compliance management, heightened security measures, and employee self-service interfaces. Instead of being weighed down by duties or investing heavily in outdated technology, companies can utilize cloud solutions to achieve precise outcomes in less time and at reduced expenses. Embracing cloud-based payroll software positions businesses for success while offering the adaptability to meet requirements efficiently.